Imagine

you bought a beautiful gold necklace five years ago for a family wedding. You

remember the rate of gold being

significantly lower back then. Today, as you look at the news and see the gold

price in India touching new highs, you decide it is the perfect time to

liquidate that piece for some urgent business capital or a home renovation.

But,

when you go and raid the jewellery store, the price that they give you is so

low that it is impossible that the “spot price” that you saw on your

mobile screen one hour ago. You are struck with confusion, maybe even

frustration. Are the jeweller’s actions unfair?

This

is a common experience for many Indian households. Understanding the gap

between the “market rate” and the “in-hand value” is

essential for making sound financial decisions. As a veteran in the financial

advisory space for over two decades, I have seen many individuals lose out on

value simply because they didn’t understand how the gold price is restructured

during a resale.

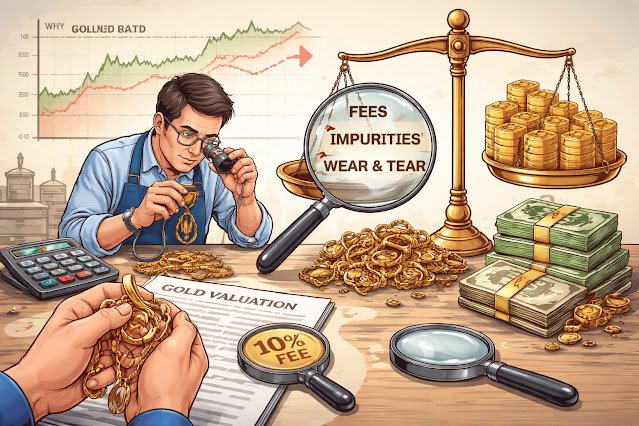

The Anatomy of the Gold Price Gap

When

you see a gold price in India advertised on news channels or financial

websites, you are usually looking at the “Spot Price” or the

“IBJA (Indian Bullion and Jewellers Association) Rate.” This is the

price for 24-karat (99.9% pure) raw gold bullion. When you sell used jewellery,

you aren’t selling raw bullion; you are selling a finished product. Here is why

the numbers don’t match up.

1. The Purity “Karat”

Factor

Most

jewellery is made of 22K or 18K gold because 24K is too soft for intricate

designs. If your piece is 22K, it only contains 91.6% pure gold. Naturally, a

buyer will only pay for the actual gold content, not the alloys mixed in to

make it durable.

2. Deduction of “Making

Charges” and GST

When

you bought the jewellery, you paid for the craftsmanship, known as making

charges, which can range from 8% to 25% of the gold value. You also paid 3% GST

on the total.

Important

Note:

Making charges and GST are “consumption costs.” They add value to the

beauty of the piece, but they carry zero resale value. A buyer is only

interested in the raw gold content, not the labour that went into it years ago.

3. Melting and “Wastage”

Charges

To

recycle your gold, a buyer must melt it down and refine it. During this

process, a small percentage of metal is inevitably lost (oxidation or removal

of impurities). Most buyers deduct a wastage charge (typically 2% to 5%) to

cover this loss and the cost of refining.

Comparison: Buying vs. Selling 10

Grams of 22K Gold

To

make this clearer, let’s look at a hypothetical scenario based on a market gold

price of ₹75,000 for 10 grams of 24K gold.

|

Factor |

Buying |

Selling |

|

Base |

₹68,700 |

₹68,700 |

|

Making |

+ |

Excluded |

|

GST |

+ |

Excluded |

|

Wastage/Melt |

Included |

– |

|

Net |

₹79,252 |

₹66,639 |

As

you can see, there is a significant “spread” between what you pay and

what you get back.

Should You Sell or Pledge? The

Liquidity Dilemma

Should

you be in a situation where you require money very quickly, selling your gold

can seem like the fastest way out. But you have to question whether this is a

lasting need or just a passing one.

When

you sell, you lose the asset forever. If the gold price in India continues to

rise, as it historically has, you miss out on that future appreciation. This is

where a gold loan becomes

a strategic alternative. When you opt for a loan, you still own your gold. You

are basically “leasing” cash from your property.

A

practical choice for many is Muthoot Finance, which has been ranked as India’s

No. 1 Most Trusted Financial Services Brand for eight consecutive years by the

TRA Brand Trust Report 2024. With a legacy built over an 800-year family

business history, they offer a way to unlock liquidity without permanently

parting with your family assets.

Recommendations for Maximum Value

In

case selling is the only option, here are some of the things you can do to

avoid being undervalued:

· Check

the Hallmarking: The BIS (Bureau of Indian Standards) hallmark is proof

of purity. A buyer may deduct a higher “melting loss” if the gold is

not hallmarked.

· Clean

the Jewellery: Dirt and oils can add weight. Make sure the item is

clean before it goes on the scale.

· Insist

on an Electronic Purity Test: Try to avoid the old

“touchstone” method. Modern X-Ray Fluorescence (XRF) machines give an

accurate purity reading without damaging the metal.

· Compare

the Buy-Back Policy: Check if the original jeweller has a

buy-back policy. Often, they offer their own pieces at a slightly better rate.

Making the Right Choice

for Your Future

The

decision to part with gold is often emotional and financially heavy. Whether

you are looking to reinvest or settle a debt, transparency is your best friend.

Always remember that the rate of gold you see on the news is a starting point,

not the final destination.

If

your need for cash is temporary, a loan ensures your assets stay safe. For

instance, Muthoot Finance serves over 2.5 lakh customers daily and protects

assets with a world-class 7-layer security system, including 24/7 monitoring

and high-tech strong rooms. This ensures your gold stays secure while it

continues to appreciate in value.